Image: https://stocksnap.io/photo/FUWWT06QSK

WSIB is an insurance company that gives businesses peace of mind when you or an employee face an injury or illness that keeps you from doing work.

This coverage allows workers to take the time to recover without fear of losing their wages. The insurance also provides medical coverage and protects you in court settlements.

WSIB, located in Ontario, is one of the largest insurance companies in North America as they provide coverage to over five million people. If you have a business in Ontario, Canada, registering with WSIB is a good idea.

By registering with WSIB, not only will your business be covered, but you will also have access to experts for health and safety guidance and programs to improve the safety of your workplace.

This article will show you when to open a WSIB account and how to open a WSIB account.

When to Open a WSIB Account

You must open an account with WSIB within 10 days of hiring your first employee.

An employee is defined as a traditional employee on the payroll, any family member that comes on board or a sub-contractor that you hire.

If you run a construction business, registering is required by law. Even if you, yourself, is an independent contractor with no employees, you may still need to register.

Other businesses that need to register after hiring an employee are:

- Restaurants

- Bars

- Sales and Services

- Agriculture

- Manufacturing

- Trucking or Transportation

You are not required to register your business if you own one of the following and have employees:

- Banks

- Trusts and Insurance

- Trade Unions

- Private Schools or Day Cares

- Travel Agencies

- Photography

- Barbers

- Funeral Homes

Even if you don’t have to register, you are still able to give your employees insurance through WSIB. And if your business was not listed, you are able to check whether you should register or not here.

How to Open a WSIB Account

Opening a WSIB account is very convenient with its online portal. You will need to gather documents about your business and then apply online.

When gathering your business information, be sure to collect the following:

Company Information

You will need the legal and trade names of your company, your company’s Canada Revenue Agency (CRA) number, addresses and contact information of all locations, your company’s bank name and contact information of anyone who deals with payroll.

You will be asked for a description of your business activities, descriptions of products that you produce or the goods and services you provide, and payroll information for any other business activity you do.

Owner Information

You will need addresses, birth dates, and titles of all directors/owners of the company.

Employee Information

You will need the date of when your first employee was hired and how many people have been hired.

Payroll Information

You will need an estimate of insurable earnings that you will pay your employees this year.

An extensive list of information needed can be found here.

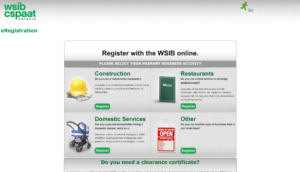

After you have your information, you can start the process by going to the registration page and clicking your business type.

There are 4 sections to fill out.

You will need to give authorization on the “Getting Started” page, describe your business on the “Business Activity” page, give out contact information on the “Company Profile” page and then submit on the “Confirmation” page.

After submitting, WSIB will review your account and email your WSIB account number along with further information.

After Registering

After opening an account, WSIB will send you a letter with information on premium reporting due dates. You will then be able to use the website to obtain a clearance, claim an injury or illness and upload documents.

You will then have obligations to uphold health and safety regulations in your workplace. This includes having first-aid equipment on hand, reporting accidents and staying connected to employees that are facing injury or illness.

WSIB will also connect you with programs to help you form a safety plan.

Take care of your employees through the coverage and safety plans provided by WSIB.